I have never claimed to be an economics “expert” or anything remotely close, but my university years did make me well familiar with certain aspects of higher math as course requirements and quantitative methods of social science research, especially as applied to the demographics of any particular culture and society. So, through this prism and the perspective of largely a layman on the topic, I have looked at all the numbers I could find on this topic, and I attempted to condense them to a core of those most pertinent, in order to present a fairly comprehensive overview of where America’s economic future currently stands.

From where I’m sitting, the news isn’t good, but then again, I’m not in the government and privy to all the hidden factors that may eventually enter the equation. If one goes off known quantities that have been verified and documented and recorded, it’s really hard not to conclude that every nation worldwide is in a bit of a financial struggle at the moment. We just happen to be struggling at the top of the heap, so to speak. But, when the proverbial “Stuff hits the fan” it ain’t going to be pretty, not when it will take a bushel barrel full of this queer fiat money to buy a single loaf of bread, and everybody and his brother are fighting in the streets wondering just what in the hell happened.

Stay the current course and I envision a nation that could easily erupt in insurrection and civil violence, split according to geographic regions or fall to authoritarian rule. The primer has been set, and all that awaits is the charge to set it off.

“The suspicions that the system is rigged in favor of the largest banks and their elites, so they play by their own set of rules to the disfavor of the taxpayers who fund their bailout, are true. It really happened. These suspicions are valid.” ~ Neil Barofsky, TARP Inspector General

America is witnessing President Trump’s “I’ve abandoned free market principles to save the free market system”” moment, similar to former President George Bush on November 16th 2008 and the high-speed implementation employed by former President Obama in 2009, as Trump presented his 2021 Budget and a $4.8 trillion spending plan to the press on February 10th. It is a farce of a “budget”, since it doesn’t even balance until 2035, according to the Wall Street Journal, and it sells America a load of economic crap, that includes the same old out-of-control socialist spending, now adopted by the Republican Party too, minus the taxes, and certain to harm America; given the socialist trends in the ranks of the Millennials, the Democrats are certain to hold the White House during a few of these years and take full advantage of Trump’s lapse in judgement on this issue.

On January 18th 2020, the Washington Post reported: “To those who criticized his spending and the growth of the national debt, Trump said: ‘Who the hell cares about the budget? We’re going to have a country.’

On January 18th 2020, the Washington Post reported: “To those who criticized his spending and the growth of the national debt, Trump said: ‘Who the hell cares about the budget? We’re going to have a country.’

For most of President Barack Obama’s time in office, Republicans seemed to care very much about the budget, making fears around the national debt and deficit their top talking point. They’ve backed off those concerns under Trump.”

President Trump’s proposal will run a near trillion dollar, $996 billion, deficit next year, just as he did in the previous years of his administration, that is close to fifty-percent higher than the $666 billion deficit Trump inherited from President Obama in 2017. Federal spending will accelerate from $4.6 trillion next year to more than $6.5 trillion in 2030, and the proposed cuts to be made by Congress in this year’s budget are not significant enough to offset the recent spending increases Trump has approved since taking office.

And all of this with our national debt at over $23 trillion, rapidly on its way to $24 trillion.

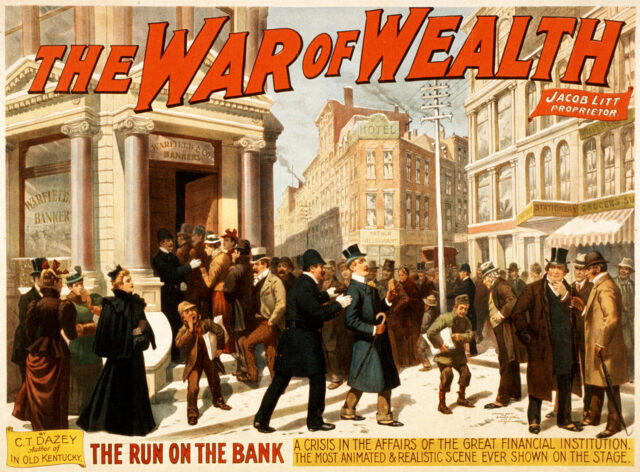

Has America so soon forgotten the worse economic recession since the 1930s — the 2008 economic collapse and the collapse of fifty percent of the stock market — and the terrible risks banks and businesses took that created it? Not much has changed, because many of the financial markets proceeded, from the first day of the bailout, that followed, to the present, with the same exact risky practices. They know the government, essentially the U.S. taxpayer — the American people, will bail them out again, that is if there’s any money or credit line available for a bailout, which is going to be unlikely.

Midway of 2008, the United States’ national debt was approximately $9.4 trillion and right at 65 percent of the Gross Domestic Product. Consumer debt stood at $2.7 trillion, while the total credit market debt had peaked at $54 trillion. And mortgage debt was a massive $14.8 trillion, as the Federal Reserve balance sheet remained below $900 billion as it had for years.

Most logical minded Americans believed then and now that there is not any such thing as “too big to fail”, and they thought the regular bankruptcy laws could have handled the situation and allowed the crisis to settle itself. People understood that liquidating bad debt and expunging it from the system would reset the economy forcing corporations and consumers to live within their means and act conservatively, using debt wisely for real needs, and most of us saw that as the best road to take for America’s future.

AIG, Lehman Brothers, Goldman Sachs, Citicorp, Bank of America and several other “too big to fail” banks were bankrupt by September of 2008. They should have been liquidated through existing bankruptcy law, and their assets should have been sold to still reputable banks that had not undertaken fraudulent risks, that hit their investors with devastating consequences.

Nobody in 2007 would have ever forecast that the national debt would climb to over $23 trillion during the past twelve years, or that the national debt would be 105 percent of GDP, with consumer debt exceeding $4 trillion. The ruling class “elite” of both parties have had their propaganda machines operating at warp speed to convince Americans that somehow $1 trillion annual deficits are normal and sustainable.

Never underestimate the ability of this president, or any president, or any Congress and the Federal Reserve to take outrageous and reckless steps to convince America that the abnormal is really normal. One should always keep in mind the egregious $700 billion TARP bailout and the lies and threats Hank Paulson perpetrated in order to protect his billionaire pals, whenever one gives scrutiny to today’s events.

President Donald Trump promised to eliminate the national debt in eight years, and although I thought it was an impossible task at the time, I did think Trump might reduce spending quite a bit, along with reducing annual deficits. He was constantly haranguing the Federal Reserve’s moves to keep interest rates at an unsafe level, which created a stock market bubble and contributed to the exorbitant rise in debt; and, one would have thought that after experiencing one Federal Reserve induced market crash after another, the American people would have realized this gross rise in debt since the 1990s had to end.

But Trump’s relationship with the Truth is something far less than stellar, and for him, it is something to manipulate at the drop of a dime and to shift in content depending on the President’s immediate need and desired effect. And over the years, he has used this manipulation to bend Fed puppet, Jerome Powell, to do his bidding, after finding the Fed’s 2.25 percent rate increase too much to handle.

In July 2019, President Trump stated: “The U.S. economy would grow more quickly if monetary policy were eased. If we had a Fed that would lower interest rates, we would be like a rocket ship. We don’t have a Fed that knows what they’re doing. Our most difficult problem is not our competitors, it is the Federal Reserve. The Fed raised rates too soon, too often, and doesn’t have a clue!”

That’s quite contrary to what Candidate Trump was saying on the campaign trail in September 2016, when he stated: “They’re keeping the rates down so that everything else doesn’t go down. We have a very false economy [something I’ve stated for years now]. At some point the rates are going to have to change. The only thing that is strong is the artificial stock market. The U.S. economy is in a big, fat, ugly bubble. I will get rid of the nation’s more than $19 trillion national debt over a period of eight years. I’m renegotiating all of our deals, the big trade deals that we’re doing so badly on. [And still are, i.e. USMCA]”

Will the Real Donald Trump please stand up? It’s almost as though we have a president with multiple personalities, at least two at conflict with one another.

Trump’s proposed $4.4 trillion cuts to domestic spending, including $2 trillion in promised savings from entitlement programs, with some $844 billion cuts to Medicaid and $750 billion to Medicare spread over the next decade. With Congress unlikely to cooperate on this and Trump unwilling to spend too much political capital on it, this will probably fall by the wayside. After calling for fairly large domestic spending cuts in 2018, Trump still signed a deal in 2019 that added $320 billion in spending and demolished previous spending caps.

And even when Republicans controlled both the House and the Senate, they still agreed to a bipartisan budget that increased domestic discretionary spending in all government departments, especially the Pentagon. They essentially refused to cut the State Department’s and the Environmental Protection Agency’s budgets, so whether they follow through with cutting the EPA by 26 percent in this budget is anyone’s guess.

Ironically, on February 4th, when Pres. Trump was practicing his State of the Union Speech for twenty Republican supporters, former Congressional deficit hawk, Mick Mulvaney, head of the Office of Management and Budget, argued there wasn’t any need to mention the growing deficit, because :nobody cares” about it. That’s a one-hundred and eighty degree turnaround since he campaigned to earn his spot over the OMB and a time he made deficit reduction his “central policy concern.” Mulvaney’s change of heart seems to have coincided with the Republican Tax Cuts and Jobs Act.

And, on February 7th 2020, Vice-President Mike Pence told MSNBC’s audience that deficits can help boost economic growth, which proves beyond a shadow of a doubt that the Republican Party, or at least Trump’s Republican Party, has now seeming embraced socialist and Keynesian economics and notions on spending. This same argument used by Leftists across America used to drive Republicans to some great degree of anger, whenever it was stated by Obama and his staff.

The federal subsidies are still flowing to the Repurchasing Markets at $100 billion a day, as they have since October, so corporations can buy back billions of their own stock, resulting in the artificially high stock market, the highest valuations since 2000. And in the meantime, the military is getting anything and everything it wants, as America continues to act as the World’s Policeman and our entitlement payouts are constant and on an unsustainable trajectory, as President Donald John Trump and all the feckless Congressmen in Washington, D.C. pretend all is well.

Despite boasts of the “Greatest Economy Ever”, record corporate profits, stock market the highest ever, lowest unemployment in history and the Federal Reserve balance sheet at $750 billion, approximately $150 billion lower than normal, and interest rates still at emergency levels, somehow the Federal Reserve feels compelled to cut rates and restart Quantitative Easing, although they are not using that terminology. Powell is taking Trump’s orders and acting in a way that is only ever seen during a recession or a financial crisis.

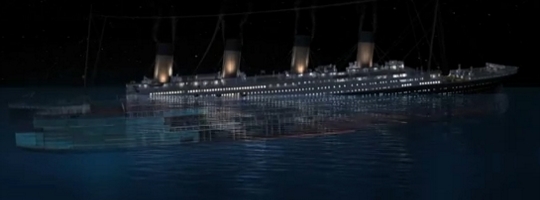

Several successive administrations have used every debt based solution for this debt based crisis in their attempt to avoid another 1930s style Depression, but essentially, they have merely ensured that the next collapse is going to be exponentially much worse than it has to be. And the angst and divisions in our society are only compounding the situation through a whispered promise of impending catastrophe that sweeps the existing social order away in a chaotic cataclysm of death and destruction and all out war.

Goin’ down?

America’s future is being stolen and sold. The future of America’s children is being stolen and sold. America is being sold down the river, pillaged and raped, by the few at the top, the “elite” ruling class, at the expense of the American people, in an egregious manner that harms all society and America during the long journey ahead towards our eventual rise from the ashes of the coming economic chaos.

February 26, 2020

~ The Author ~

~ The Author ~

Justin O. Smith has lived in Tennessee off and on most of his adult life, and graduated from Middle Tennessee State University in 1980, with a B.S. and a double major in International Relations and Cultural Geography – minors in Military Science and English, for what its worth. His real education started from that point on. Smith is a frequent contributor to the family of Kettle Moraine Publications.