Yesterday I was watching a video of Yale History professor Timothy Snyder in which he states “It’s patently clear that some of the people who’re involved in current politics…are borrowing some of the tactics of the 1920s and 1930s.” That came hours after discussing another article comparing the political talk in the UK to the rhetoric of Joseph Goebbels. And look at today’s headlines: “Turkey begins offensive against US Ally in Syria”; “Fed worried about rising economic risks from trade war”; “EU offers ultimatum to Johnson on Brexit plan”; “India and China face off over Himalayan flashpoint”; and “Two Killed in Germany Shooting After Failed Attack on Synagogue.”

Yesterday I was watching a video of Yale History professor Timothy Snyder in which he states “It’s patently clear that some of the people who’re involved in current politics…are borrowing some of the tactics of the 1920s and 1930s.” That came hours after discussing another article comparing the political talk in the UK to the rhetoric of Joseph Goebbels. And look at today’s headlines: “Turkey begins offensive against US Ally in Syria”; “Fed worried about rising economic risks from trade war”; “EU offers ultimatum to Johnson on Brexit plan”; “India and China face off over Himalayan flashpoint”; and “Two Killed in Germany Shooting After Failed Attack on Synagogue.”

I published an in-depth report early in the year all about political populism. The key message was, we are seeing echoes of the 1920s and 1930s in today’s politics because we echo the economics of the 1920s and 1930s. We had a debt-driven Gilded Age boom prior to 2008 analogous to the Roaring 20s – and then a colossal bust, analogous to 1929. Since then we have failed to work out how to deal with the debt overhang, or to co-ordinate a global recovery between countries (so all boats rise) and within countries (so all boats rise, not just yachts). We haven’t worked out how to ensure capital circulates sustainably internationally or domestically.

As a response, the “will of the people”, “us vs. them”, ‘walls over bridges’ are back: and, most worrying, now as then, for sound underlying reasons. People didn’t just slip into madness in the 1930s: as Arendt makes clear, if “normality” offers you are a raw deal, you will opt for an alternative. What is being sold via today’s populism may not be a solution: yet neither is the status quo ante. Indeed, we repeat our errors. For example, take the Fed, its history and its present.

History: The Fed allowed the 1929 crash to happen – or rather failed to stop French mercantilism driving us towards the 1929 crash, and then failed to put in place appropriate policies afterwards. It took fiscal expansion to stop the Great Depression bringing down US capitalism. However, the Fed believed the US economy had turned the corner in 1937 and started to raise rates – and was wrong, bringing the economy to its knees again. It was fiscal reflation via WW2 rearmament that then saved the day.

Present: The latest Fed minutes, covered HERE by our spot-on Fed whisperer Philip Marey, show another October rate cut is certain. Moreover, Philip sticks with his view that Fed Funds will be slashed all the way to zero before the end of 2020 as the US slides towards recession. And what kind of political backdrop, in terms of fiscal policy and defense spending (and/or the equally existential battle of a Green New Deal) do we see emerging? Exactly.

Furthermore, there are other parallels between the 1920s and 1930s and now. Again, the West is cash-strapped and less confident in itself and its economic vitality, war-weary, and unwilling to physically fight against more aggressive forces. Here’s a particular echo on those fronts.

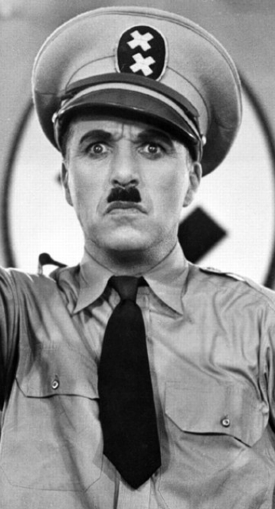

One of the crowning glories of 1940 cinema is Charlie Chaplin’s ‘The Great Dictator’, in which he plays a gentle Jewish barber as well as his look-a-like, the moustachioed European dictator Adenoid Hynkel. Hollywood holds it up as an example of US freedoms….which overlooks the fact that when Chaplin was making the film Nazi Germany was still a key export destination for movies – and so no studio would finance it. Chaplin had to fund most of the production with his own money to get it made: it proved a hit and was then embraced, and more so after WW2 started. As the barber pleads to Hynkel’s massed armies at the end of the movie:

“You, the people, have the power to make this life free and beautiful, to make this life a wonderful adventure. Then, in the name of democracy, let us use that power; let us all unite. Let us fight for a new world, a decent world that will give men a chance to work, that will give youth a future and old age a security. By the promise of these things, brutes have risen to power. But they lie! They do not fulfill that promise. They never will!

Dictators free themselves but they enslave the people! Now let us fight to fulfill that promise! Let us fight to free the world, to do away with national barriers, to do away with greed, with hate and intolerance. Let us fight for a world of reason, a world where science and progress will lead to all men’s happiness. Soldiers! in the name of democracy, let us all unite!”

All that is missing is a model for how one can do that AND ensure that capital circulates domestically and internationally. Meanwhile, the NBA and South Park (and Tiffany and Marriot and Delta, etc., etc.) issue over US freedom of speech vs. Chinese sensibilities has now escalated to the extent that a bipartisan group of US members of Congress have penned an open letter to the NBA president stating “It is outrageous that the Communist Party of China is using its economic power to suppress the speech of Americans inside the United States,” criticizing the NBA for failing to put “fundamental democratic rights ahead of profit” and for being ill-equipped to deal with the foreseeable “challenges of doing business in a country run by a repressive single party government.” The bipartisan group also makes four requests of NBA President Silver: Build upon the October 8 statement “the NBA will not put itself in a position of regulating what players, employees, and team owners say or will not say on these issues”; Suspend NBA activities in China until it ends a boycott of NBA activities; Re-evaluate the NBA’s training camp in Xinjiang, where up to a million Chinese citizens are held in concentration camps; and Clarify public commentary on international human rights repression – including Tibet, Hong Kong, and Xinjiang – falls within expected standards.

In short, not only are US-China trade talks going badly – so badly they are going to end early – but the political mood is now moving towards a broad-spectrum confrontation over economic power and the political values it can then (great) dictate – again not a surprise to us given our long-standing argument that this was never about trade per se.

From a markets perspective, The Great Dictator continues to tell us long USD and short EM FX, particularly those getting involved in trade wars or real wars. That the Fed can be cutting rates and doing NOT-QE4 and the USD still be holding up is a real signal there.

Furthermore, on the rates front, lower for longer still rules – if history is any guide at all. Of course, “history doesn’t repeat itself, but it rhymes” – and The Global Daily does repeat itself, and doesn’t rhyme.

Written by Michael Every and published by Zero Hedge ~ October 10, 2019