Health Insurance, My ASS!

Today I was introduced to the 2025 version of United Health Care, as I went to my Pharmacy to pick-up one of my heart related prescriptions. In January of 2024, a 90 day supply of 180 capsules cost me about $134.00. In April the same prescription cost me about $440.00. Tonight, it cost me $387.00 for a 30 day supply. That is enough to cause me another heart attack.

It has now become HELL INSURANCE! ~ Editor

American health insurance seems to frustrate everyone. Patients complain that it’s expensive and complicated. Providers say it buries them in paperwork and can negatively affect patient care.

American health insurance seems to frustrate everyone. Patients complain that it’s expensive and complicated. Providers say it buries them in paperwork and can negatively affect patient care.

Yet identifying a villain in our health payment story is no simple matter.

The American health payment system is a ramshackle structure comprising public and private insurance plans offered by a host of providers across multiple states. Here’s an overview of the symptoms affecting the health care payment industry, some root causes, and cures suggested by industry analysts.

~ Symptoms ~

The most frequent complaint about health insurance is the cost. The cost of employer-sponsored insurance (ESI) for a hypothetical family of four in 2024 was $32,066, according to the actuarial firm Milliman. Of that total, about 58 percent would typically be paid by the employer.

Cost is a major complaint for employers too. “The growing refrain within small and mid-sized businesses is that providing health insurance for their employees is becoming unsustainable,” Orriel Richardson, an executive director at Morgan Health, a business unit of JPMorgan Chase aimed at improving health care, told The Epoch Times.

Another pain point is the complexity of the plans. Consumers say this makes their coverage difficult to use and often seems unfair. Nearly two-thirds of Americans, 65 percent, said they don’t think health insurance providers are transparent about their coverage, according to a 2024 poll conducted by physician network MDVIP and Ipsos.

Providers are frustrated too. The administrative demands required by insurance companies are a particular pain point. Experian found that 65 percent of providers said meeting the insurers’ claim-submission requirements is harder now than before the pandemic.

Insurance companies are aware of the problems. Andrew Witty, CEO of UnitedHealth Group, said as much in an op-ed in The New York Times just days after one of his executives was gunned down in New York.

“We know the health system does not work as well as it should, and we understand people’s frustrations with it. No one would design a system like the one we have. And no one did. It’s a patchwork built over decades,” Witty wrote on Dec. 13.

~ Causes ~

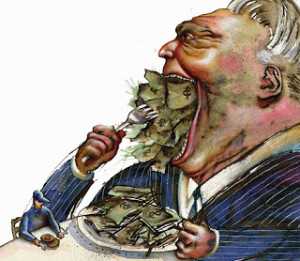

GREED!

The many silos and layers of legislation in the health payment industry make for a complex system that is difficult for Congress, let alone consumers, to understand. For example, Richardson said, “You just don’t have a sense of how one change in a Medicare program has consequences across the broader health care marketing ecosystem.”

Consolidation within the industry is another factor, as some experts say it decreases competition. Private health insurance has become more concentrated among fewer, larger insurers and care providers. The six largest health insurers in the country accounted for nearly 30 percent of all U.S. health care spending in 2023, according to an analysis conducted by Axios. That’s up from less than 10 percent in 2011.

Perhaps the most sobering root problem affecting the cost of health insurance is that Americans, on the whole, are sicker than they used to be. Millennials are significantly less healthy than their Generation X predecessors, according to a 2019 study conducted by the Blue Cross Blue Shield Association.

“Health care is just simply not working. We’re sicker, our life expectancy is lower, our quality of life is poor,” Richardson said.

~ Prescriptions for Change ~

Ideas for improving the health payment system come in two types: reboots and refinements.

Reboots include ideas for sweeping change, such as the Medicare for All proposal advocated by Sen. Bernie Sanders (I-Vt.). The proposal would create a national health insurance program to provide comprehensive health care for all U.S. residents.

Other ideas would maintain the basic framework of health insurance but make it more competitive.

Bruce Ratner, a former head of the Consumer Protection Division for New York City, advocates requiring health insurers to publish their denial rates. “That way, we choose our company based on denial rates, and that makes the companies work very hard to be competitive,” Ratner said in a Dec. 9 interview with CNBC.

Mark Bertolini, CEO of Oscar Health, advocates eliminating ESI to improve competition. “The ability of your employer to negotiate against the large insurance company that has much a larger relationship with the provider community is very stunted now,” Bertolini said in a Dec. 13 interview with CNBC.

Improving the transparency would help too, according to Richardson. One solution might be “a real transparency report that says, if a new Medicare requirement comes onboard, how do you show that effect was isolated within that Medicare book of business and not … a ripple effect went into the other books of business,” she said.

Improving the transparency would help too, according to Richardson. One solution might be “a real transparency report that says, if a new Medicare requirement comes onboard, how do you show that effect was isolated within that Medicare book of business and not … a ripple effect went into the other books of business,” she said.

Insurers could help by educating customers on how insurance works and the reasons behind their coverage decisions, according to Witty. “Together with employers, governments, and others who pay for care, we need to improve how we explain what insurance covers and how decisions are made,” he said.

Richardson likens the system to a house with several layers of shingles on the roof. “We have a house that is sustainable enough, but instead of removing the shingles to repair the roof, we keep cobbling new shingles onto it,” she said. “The very house itself is going to collapse under this patchwork of things we keep doing.”

Written by Lawrence Wilson for The Epoch Times ~ January 4, 2025