“Rather than collecting taxes from the wealthy, the government is paying the wealthy to borrow their money.” ~ New York Times, July 7, 2023

Titled “America Is Living on Borrowed Money,” the editorial observes that over the next decade, according to the Congressional Budget Office (CBO), annual federal budget deficits will average around $2 trillion per year. By 2029, just the interest on the debt is projected to exceed the national defense budget, which currently eats up over half of the federal discretionary budget. In 2029, net interest on the debt is projected to total $1.07 trillion, while defense spending is projected at $1.04 trillion. By 2033, says the CBO, interest payments will reach a sum equal to 3.6 percent of the nation’s economic output.

Titled “America Is Living on Borrowed Money,” the editorial observes that over the next decade, according to the Congressional Budget Office (CBO), annual federal budget deficits will average around $2 trillion per year. By 2029, just the interest on the debt is projected to exceed the national defense budget, which currently eats up over half of the federal discretionary budget. In 2029, net interest on the debt is projected to total $1.07 trillion, while defense spending is projected at $1.04 trillion. By 2033, says the CBO, interest payments will reach a sum equal to 3.6 percent of the nation’s economic output.

The debt ceiling compromise did little to alleviate that situation. Before the deal, the CBO projected the federal debt would reach roughly $46.7 trillion in 2033. After the deal, it projected the total at $45.2 trillion, only slightly less – and still equal to 115% of the nation’s annual economic output, the highest level on record.

Acknowledging that the legislation achieved little, House Speaker Kevin McCarthy said after the vote that he intended to form a bipartisan commission “so we can find the waste and we can make the real decisions to really take care of this debt.” The NYT Editorial Board concluded:

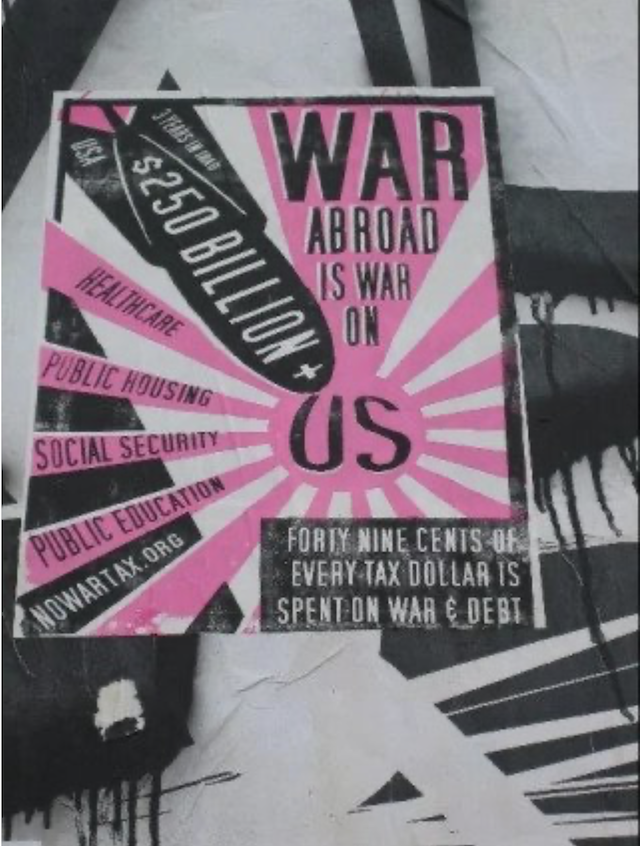

Any substantive deal will eventually require a combination of increased revenue and reduced spending …. Both parties will have to compromise: Republicans must accept the necessity of collecting what the government is owed and of imposing taxes on the wealthy. Democrats must recognize that changes to Social Security and Medicare, the major drivers of expected federal spending growth, should be on the table. Anything less will prove fiscally unsustainable. (Continue to full column…)