Update: U.S. Treasury Secretary Janet Yellen rules out a bailout of collapsed Silicon Valley Bank.

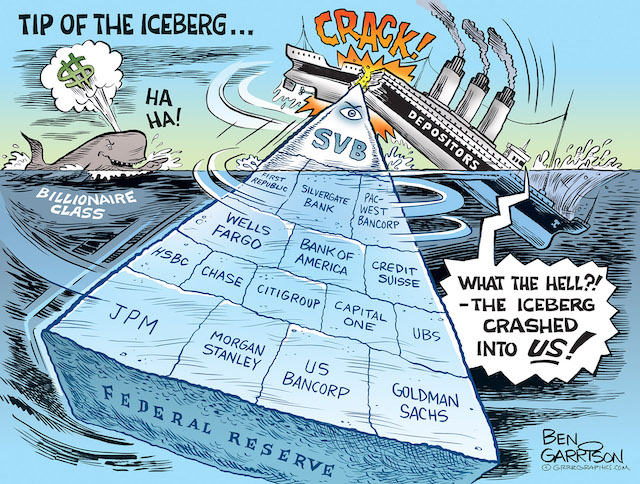

Silicon Valley Bank is yet another example of corruption in the banking sector. I’ve read that SVB is the second largest banking failure in US history.

Silicon Valley Bank is yet another example of corruption in the banking sector. I’ve read that SVB is the second largest banking failure in US history.

A woke and ‘green’ bank, SVB was devoted to ‘DIE,’ or Diversity, Inclusion, and Equity.

Maybe the latter in particular contributed to their collapse, but before it did go bust executives running the sorry show made sure they cashed out of their stock and rewarded all the top executives with generous bonuses. The taxpayers will pick up the rest of the tab via FDIC insurance…

A lot about this bank collapse sounds familiar. Jim Cramer recommended the stock ahead of its demise—just like he did with Bear Stearns and Lehman Brothers. Of course, Cramer should be put on the ignore list after he pounded the table and insisted on forced Covid vaccinations for everyone in America. The man sided with tyranny. Don’t side with him – ever again.

Then there is the billionaire class that always seems to come out on top. Peter Thiel’s fund withdrew most of its money out of SVB just in time. Perhaps Thiel possessed better inside information due to his Palantir ball or something, or it could be that he is smart and always knows when it’s time to ‘get out.’ My point is the insiders always have the advantage. Regular investors become bag holders.

We need a criminal investigation into SVC, but most likely they will be bailed out before the collapse of more financial institutions is triggered. We know Wells Fargo has problems, almost on a continuous basis. Apparently deposits were disappearing and many customers complained of incorrect balances. WF is a criminal organization that has already paid large fines in the past – just like Pfizer.

I’m hardly the one to dispense financial advice, but be careful with banks – especially the large ones. I once went ‘all in’ on silver and I was convinced that I would make a fortune. Instead JPM crushed silver through illegal shorting and manipulation. They paid a fine, but the damage was done. Starting on May 1, 2011, their traders illegally colluded and shorted silver – and in a year or two the shiny metal collapsed down to $13. It forced me to realize just how much power and influence the big banks possessed. The average Joe stands no chance against them. That’s why I would not keep an inordinate amount of money in any bank – especially during these unstable times. One could wake up and find their banks declaring bankruptcy and their money gone.

The ultimate blame belongs to the Federal Reserve. It was set up with the promise of ending booms and busts. Instead, they intentionally brought about continuous booms and busts. The Roaring 20s and easy credit. Then the Great Depression made longer by FDR’s bad policies that benefited big banks who wanted to buy up infrastructure for pennies on the dollar. Then we had the post-WWII boom, the inflation bubble caused by the Vietnam War and LBJ’s ‘Great Society’ spending. We experienced very high interest rates under Jimmy Carter. Fed Chairman Paul Volcker stepped in and raised them to ridiculous highs in order to counter inflation as well as crush the gold and silver ‘bubble.’ Then we got the housing bubble, the Internet bubble, the post-9-11 stock market crash, and the 2008 bank crash due to their criminal manipulation of housing derivatives. After that we got the ‘everything bubble,’ which may be crashing right now. Will SVB trigger more failure? Maybe not right away, but the dollar is fundamentally flawed and it won’t take much for another Great Depression. Perhaps the BRICS countries will trigger it. Or maybe WWIII.

The ultimate blame belongs to the Federal Reserve. It was set up with the promise of ending booms and busts. Instead, they intentionally brought about continuous booms and busts. The Roaring 20s and easy credit. Then the Great Depression made longer by FDR’s bad policies that benefited big banks who wanted to buy up infrastructure for pennies on the dollar. Then we had the post-WWII boom, the inflation bubble caused by the Vietnam War and LBJ’s ‘Great Society’ spending. We experienced very high interest rates under Jimmy Carter. Fed Chairman Paul Volcker stepped in and raised them to ridiculous highs in order to counter inflation as well as crush the gold and silver ‘bubble.’ Then we got the housing bubble, the Internet bubble, the post-9-11 stock market crash, and the 2008 bank crash due to their criminal manipulation of housing derivatives. After that we got the ‘everything bubble,’ which may be crashing right now. Will SVB trigger more failure? Maybe not right away, but the dollar is fundamentally flawed and it won’t take much for another Great Depression. Perhaps the BRICS countries will trigger it. Or maybe WWIII.

We live in perilous times. We could see some ’titanic’ economic destruction. I still favor “real money:” gold and silver, but it wouldn’t hurt to stock up on storable food, ammo, and easily-traded items such as packs of cigarettes, toilet paper, medicine, and/or small bottles of booze.

Ben Garrison

March 12, 2023