Hugo Salinas Price

A logical analysis of daily action in the NY gold market reveals constant intervention by the US/British banking Mafia, to drive the price of gold down: a free-market price of gold would have the undesireable consequence of revealing the worthlessness of the US Dollar, which cannot be allowed to happen, as the US Dollar underpins the worth of the currencies of the rest of the World.

In an authentic free market, most buyers of gold want to obtain as much gold as possible, in exchange for the currency they tender in payment. Therefore, most rises in the price of gold take place slowly; however, some buyers of gold wish to obtain as much gold as possible, at any price and as soon as possible, and this causes swift, nearly vertical rises in the price of gold as registered on the graphs.

However, the World does not have an authentic free market for gold. There are banking entities that work hand in hand with the Central Banks of Britain and the US, to control the price of gold, by preventing its price from rising, or by bringing its price down to discourage owners and prospective owners from investing in gold

A tell-tale sign of Official Intervention in the gold market are the swift collapses in the price of gold which take place frequently. Unofficial, “bona-fide” sellers of gold wish to maximize their Dollar profits when they sell their gold – they do not “unload” their gold on the Market, all at once.

The Official sellers of gold do not care about “maximizing their Dollar profit”. They are interested in only one thing: to bring down the price of gold as fast as possible, in order to scare away potential investors and “flush out” weak hands. Thus, the tell-tale signs of Intervention appear in the the daily graphs of the price of gold, as near vertical falls in the price of gold.

Some examples:

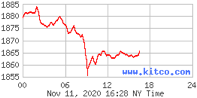

Nov. 11

2:30 a.m. NY, gold was trending higher and stood at about $1884. TPTB decided it was time to halt the rise and sold down to $1875. At 7:00 a.m. TPTB sold hastily and down to $1855, with evidently no intention of maximizing dollar profit.

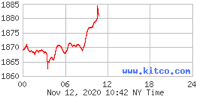

Nov. 12

4:30 a.m. NY, gold was slapped down from $1868 to $1862.50. A progressive rise took place as buyers lifted the price to $1885, followed by a swift Intervention downward, that took the price to $1880 at about 11:00 a.m.

Nov. 16

6:30 a.m. drastic Intervention crashed the price from $1891 to $1866 in a question of minutes. No interest on the part of the Seller to maximize Dollars obtained – quite evident that the only purpose was to kill the price.

Nov. 17

3:30 p.m. gold price is slapped down from $1885 to $1877.50 in minutes. The gold market is by no means, a free market. It is a market strictly controlled the TPTB.

Nov. 18

At 4:00 a.m. gold is at $1885. The control of the price of gold is activated, and the price descends $20 in the course of the next 3 hours, to $1865.

Nov. 19

Four swift falls in the price gold – the sure mark of Intervention: at 12:30 a.m., at 4 a.m., at 5 a.m, and a final swoop at 7:30 a.m. – from $1862 to $1857.

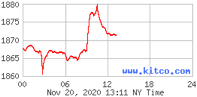

Nov. 20

After recovery from a smack-down from $1867 to $1860, at 8:00 a.m. buyers rush in and raise the price of gold to $1880.

Nov. 23

At 10:00 a.m. the price of gold exhibits the classic sign of Intervention: making a profit is out of the question. The objective is to collapse the price of gold, and the price of gold is driven down from $1868 to $1830 by 11:30 a.m.

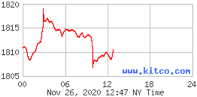

Nov. 26

Buyers eager to obtain gold, raise its price from $1808 to $1819 from about 1 a.m. to 3 a.m. Intervention reappears at about 9:30 a.m. and the price of gold is swiftly – and unprofitably! – brought down to $1806.

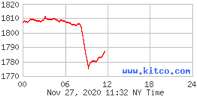

Nov. 27

Official intervention presents itself, as clear as day, at 8 a.m., when the price of gold is $1803, and gold is driven directly – and unprofitably – to $1775 from about 8 a.m. to 9 a.m.

Further comment:

As of November 30, at 3:47 p.m. NY Time, the price of gold stood at $1,780.

TPTB have successfully driven the price of gold down $220 Dollars, from $2,000 to $1780: down a neat 11%.

Whether the price will now rise, or will be driven further down, remains to be seen.

The problem for the “Controllers” is that the lower the price of gold goes, the more attractive it appears to buyers! At $1780, the buyer gets 12.35% more gold than he did at $2,000. A true bargain!

If we put gold alongside the present political context in the US:

a) There are rumors that President Trump is not going to concede the electoral victory to Biden. That he is going to take very ugly measures against his political enemies and that he is going to reject the results of the recent election, declare himself the winner and remain in Power with the consent and support of the Military – the social group that has time and again, all over the world, exerted its power for the resolution of conflicts.

b) If Biden does obtain the Presidency of the US, the Democratic Party is the Party for Spending, and given the present deplorable financial condition of the US, that would further erode the value of the Dollar.

Stay tuned!

Written by Hugo Salinas Price for In This Age of Plenty ~ December 1, 2020